KPRA held an orientation session for Women Entrepreneurs

KPRA held an orientation session for Women Entrepreneurs

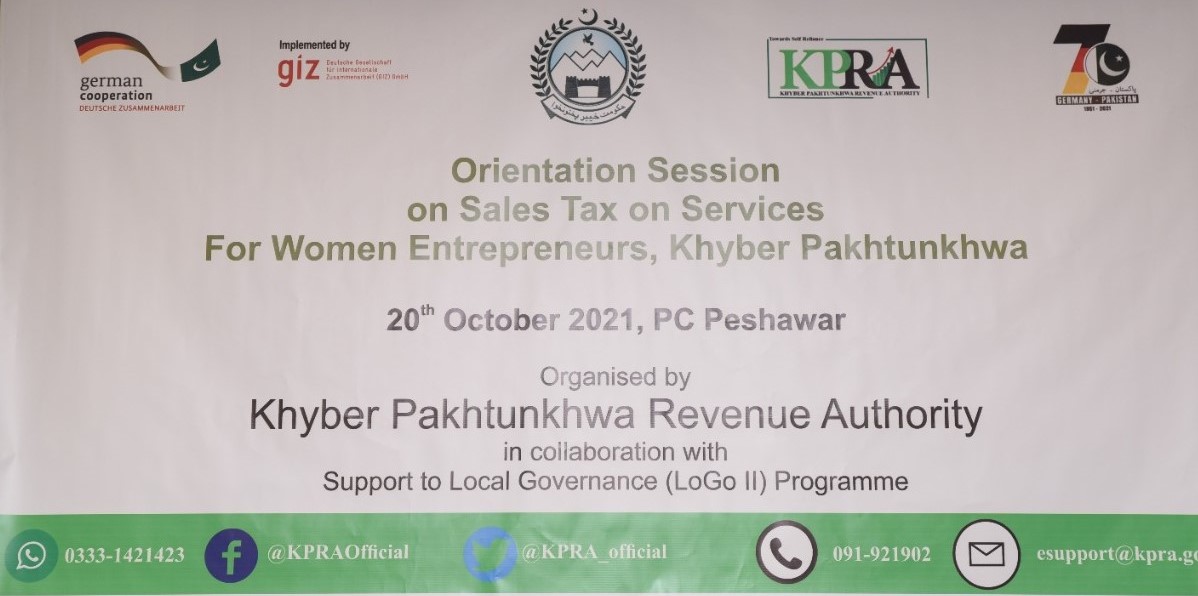

To facilitate women entrepreneurs and encourage tax compliance, the Khyber Pakhtunkhwa Revenue Authority (KPRA) arranged an orientation session for women entrepreneurs of Peshawar on Wednesday.

The orientation session was organized with the financial assistance of German Agency for development GIZ at PC hotel Peshawar. The participants of the session were mostly associated with beauty salons, who were given presentations regarding sales tax on services by the officials of KPRA and answered their questions. The participants were given on-spot demonstrations regarding how to file monthly returns and how to pay their taxes through banks or other funds transfer channels. They were introduced with Salon Invoice Monitoring System (SIMS) developed by the IT team of KPRA specifically for the beauty parlors and the invoices generated through the system can be verified through the website of KPRA to make sure that the tax charged by a salon has reached to the KP government or not. The participants were given a demonstration of the system and they were told how to use it and take benefits from the features it offers.

The KPRA officials including Additional Collector Fazal Amin Shah and Director Abdul Haleem assured complete support to the women entrepreneurs in issues relating to KPRA.

The KPRA officials also told the participants that the rates of sales tax on services on beauty salons have already been reduced to merely 5% and it can further be reduced if the association of salons assures hundred percent tax compliance with KPRA. “In KPRA, we call the taxpayers as our stakeholders and we do our best to facilitate them,” said Fazal Amin Shah highlighting the role of KPRA and its working. He told the participants that female officers of KPRA will be designated to facilitate women entrepreneurs in matters relating to KPRA. Speaking about the importance of the sales tax on services for the public Fazal Amin Shah said that the financial cost of the Sehat Insaf Card is Rs22 billion annually while the KPRA collected around Rs21 billion in the last financial year which means that the government will enough to spend on healthcare if people pay their sales tax on services.

“KPRA is contributing over 50 percent of the province’s own source revenue with its limited staff and we need your support to make sure 100 percent tax compliance to increase fiscal space for the government so that it can have enough resources to spend on public uplift schemes,” Director KPRA Abdul Haleem Khan said adding that KPRA values the participation of women entrepreneurs in the uplift of the province which is why it has been focusing on issues of women and it has kept female officers for the facilitation of female taxpayers.

“Our system is completely transparent and if you have any issues relating to KPRA just let us know. We will take care of it,” Abdul Haleem said adding that more such programmes will be conducted for the education of the women entrepreneurs.

Former minister and former senior vice president of WCCI Asia Jahangir thanked GIZ and KPRA for arranging the event and said that such events should be arranged for the education of the female taxpayers.

President Women Chambers of Commerce and Industries Shahida Parveen lauded the efforts of GIZ and KPRA for arranging the orientation session and called for more such sessions to create awareness and overcome the gap between government and the private sector. “We understand the importance of taxes which is why we have kept it in prerequisites for salons to get KPRA registration before becoming member of Women Chambers of Commerce and Industries,” she said