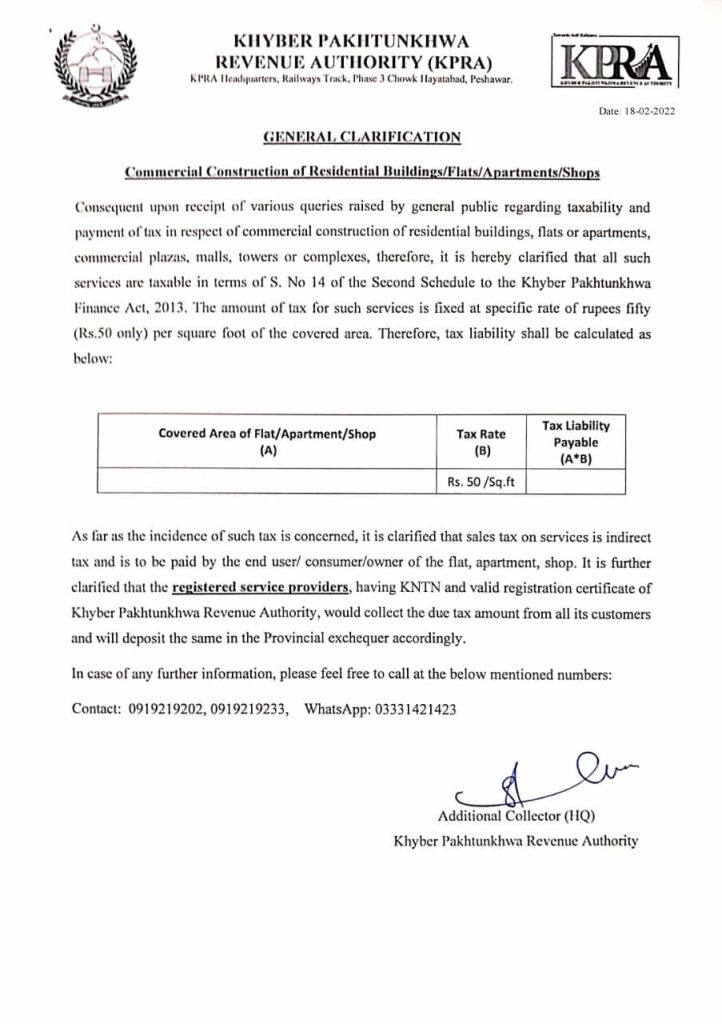

Commercial Construction of Residential Buildings / Flats / Apartments / Shops

Attention Please:

Construction of residential buildings, flats or apartments, commercial plazas, malls, towers or complexes are taxable in terms of S. No 14 to the Second Schedule of the Khyber Pakhtunkhwa Finance Act, 2013. The amount of tax for such services is fixed at specific rate of Rs 50 per square foot of covered area.

Furthermore, it is also clarified that sales tax on services is indirect tax and is to be paid by the end user/consumer/owner of the flat, apartment, shop. For details please read the clarification document or contact number given in it.

Thank you