About

About KPRA

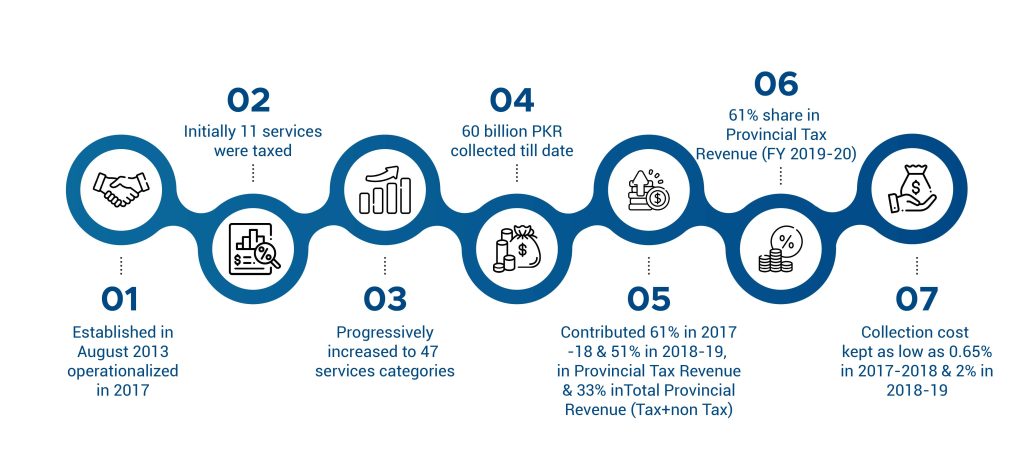

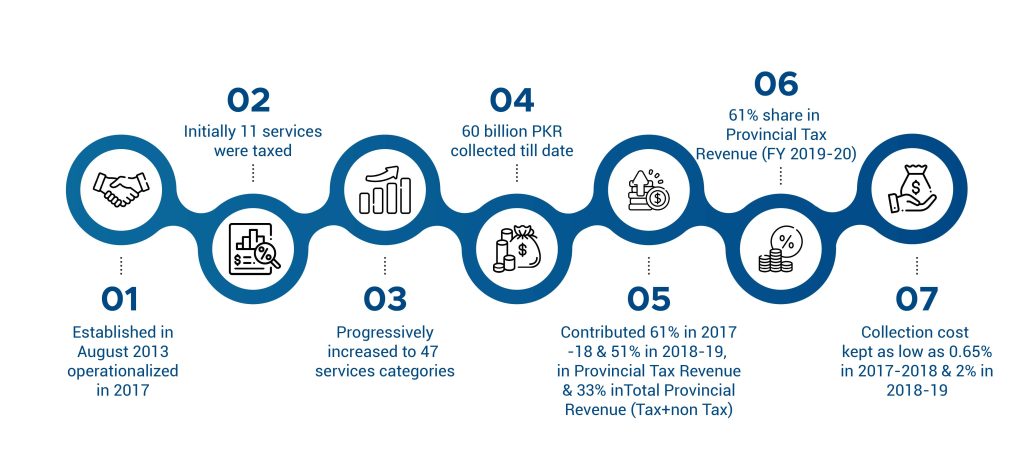

Khyber Pakhtunkhwa Revenue Authority (KPRA), as corporate entity, was established under the Khyber Pakhtunkhwa Finance Act, 2013, with the mandate to administer and collect Sales Tax on Services & Infrastructure Development Cess. KPRA is governed, with relative autonomy, has been placed under the Finance Department to have an interface with the Government. While, the Council acts as Policy Making body chaired by the Honourable Chief Minister, Khyber Pakhtunkhwa, and comprising of three (03) Cabinet Ministers for Finance, Law and Excise and Taxation, Chief Secretary, Secretaries of the Finance, Law, Excise, Taxation and Narcotics Control departments and four representatives nominated by the Government from the private sector.

The tax system in Khyber Pakhtunkhwa reflects a narrow base and fragmented revenue administration through various departments namely: Revenue & Estate and Excise and Taxation etc. KPRA has emerged as the largest tax collection authority of Khyber Pakhtunkhwa, contributed 33% to the Total Provincial owned receipts and 56.42%, 61% & 51% to the Total Provincial Tax Revenue for the year 2016-17, 2017-18 & 2018-19 respectivly. KPRA was envisioned to enhance fiscal space for social development in the province. The Authority has generated total revenue of Rs. 60 billion since its inception.

KPRA has faced several challenges since its beginning including frequent changes in the top management. Nevertheless, it has generated significant revenue through expanding the tax base for services, informed compliance and introducing automated systems and processes. However, the delayed operationalization negatively impacted the desired goals of tapping of the potential revenue.

Notwithstanding the above, the year 2017 proved to be productive in terms of not only achieving the revenue targets set by the Provincial Government; but also progressed on institutional development in its true spirit. The Authority was able to frame necessary by-laws under the Finance Act, 2013, devised organizational structure on the basis of human resource assessment. Besides, successfully completing the recruitment process by employing capable human resource.

Additionally, KPRA also devised several strategies including elaborate communication strategy for increased emphasis on informed compliance. The transition team of KPRA was also successful in securing the technical assistance of multiple development partners for assistance in governance reforms.

Transparency and organizational integrity is the hallmark of KPRA being nascent financial institution. Besides an efficient financial management system is in place ensuring preparation of financial statements of the accounts, statement of revenue receipts, its reconciliation with the Accountant General, Khyber Pakhtunkhwa; and regular conduct of external and internal audit, managing risks, and continuous monitoring of internal processes in order to build confidence of the taxpayers and achieve the strategic goals of KPRA.

Vision

We strive to make Khyber Pakhtunkhwa self-reliant through progressive tax policy.

Mission

To Contribute substantially to provincial own receipts through improved tax administration, enforcement of tax laws and provision of quality services.

Our Values

- Integrity

- Professionalism

- Innovation

- Collaboration

- Transparency